Starting a business is like planting a tree. Just as a seed needs soil, water, and sunlight to grow, a business needs money to start, operate, and expand.

This initial investment is what we call “startup capital,” and today, I will talk about everything you need to know about it.

Table of Contents

ToggleWhat Does Startup Capital Cover?

Imagine you have a great idea for a lemonade stand. Before you sell your first cup, you’ll need a table, cups, lemons, sugar, and a sign to attract customers.

Startup capital is the money you use to buy these items and pay for any other expenses until your lemonade stand starts making more money than it spends.

It’s used for:

- Paying bills and rent for your business space

- Salaries for any employees

- Buying materials and inventory

- Marketing to let people know about your lemonade

But how do you begin saving for startup capital, where does the money even come from?

Where Does Startup Capital Come From?

Finding the money to start a business can come from several places:

| Funding Source | Advantages | Challenges |

|---|---|---|

| Personal Savings | No requirement to repay funds or give up equity, complete control over business decisions. | High level of personal financial risk. |

| Crowdfunding | Dual-purpose of raising funds and market validation, wide audience reach. | Requires effective marketing and a compelling story. |

| Business Loans | Ability to retain full ownership, suited for significant capital needs. | Potential financial strain from repayment obligations. |

| Venture Capital | Significant capital infusion without immediate repayment, access to expertise and networking. | Must give up a portion of business and possibly some control, highly competitive. |

The Process of Raising Startup Capital

Starting with an idea, entrepreneurs go through various stages of funding to grow their businesses.

Here’s a simplified roadmap:

| Stage | Amount Raised | Source |

|---|---|---|

| Pre-Seed Funding | About $600,000 | Often, friends, family, or the entrepreneur’s own pocket |

| Seed Funding | Roughly $2.9 million | Market research and initial product development to prove the concept |

| Series A | Around $11.6 million | To expand product offerings or target markets with a proven business model |

| Series B | Close to $30 million | Scaling up to meet growing demand from customers |

| Series C and Beyond | Series C around $60 million; Series D+ can exceed $105 million | Used for broad expansion, such as entering new markets or acquiring other companies |

Alternatives and Support

Venture Capitalists (VCs)

Venture capitalists are professional groups that invest large sums of money in startups with high growth potential in exchange for equity. They’re not just looking for a return on their investment; they’re aiming for substantial returns.

This often involves taking a hands-on approach to their investments, providing strategic guidance and leveraging their networks to scale the business rapidly. The main consideration for entrepreneurs is the significant stake that VCs take in the company, which can lead to a loss of control over business decisions and direction.

Incubators and Accelerators

These programs are designed to support startups in their earliest stages, helping them to develop their business model, product, and go-to-market strategy. Incubators and accelerators offer mentorship, office space, and access to a network of investors and industry experts, often in exchange for a share of equity.

While they provide invaluable resources and support, startups must be ready to hit the ground running, as these programs are typically fast-paced and highly competitive.

Angel Investors

Angel investors are affluent individuals who provide capital for startups, usually in exchange for convertible debt or ownership equity. They are often entrepreneurs themselves or retired business executives, which means they can offer not just financial backing but also valuable insights, mentorship, and industry connections.

Angel investors are more likely to take risks on early-stage companies than venture capitalists. However, they might seek significant returns on their investment, influencing the direction and operations of the business.

Small Business Loans

Small business loans are a traditional funding route, offering a range of options often backed by government agencies, such as the Small Business Administration (SBA) in the United States.

These loans provide added security and competitive interest rates, making them an attractive option for businesses looking for minimal external interference in their operations. The challenge here lies in the stringent eligibility criteria, including credit history and the requirement for a solid business plan.

Equity-Free Financing

Emerging platforms like Republic or Pipe represent a novel approach by offering capital without requiring startups to give up any ownership stakes. This model allows businesses to maintain full control while still accessing the funds needed for growth.

The trade-off can include repayment terms based on revenue or other criteria, which requires a predictable cash flow. This option is particularly appealing for businesses looking to avoid diluting their equity while still securing necessary capital.

The Benefits and Trade-offs

Securing startup capital is a multifaceted process that extends beyond the simple acquisition of funds. It encompasses a broad spectrum of advantages and considerations that are pivotal to the growth and direction of a business.

Here are the benefits:

- Access to Mentorship: When investors provide capital, they often also offer mentorship.

- Industry Connections: Securing funding often opens doors to a wide network of industry connections.

- Valuable Resources: In addition to financial support, investors may provide access to resources such as office space, technology, and operational tools.

and here are the trade-offs:

- Sharing Profits: With external funding, startups need to share a portion of their profits with their investors.

- Loss of Control: Investors often require a say in business decisions, which can lead to a loss of autonomy for the founders.

- Pressure to Grow Quickly: Securing capital often comes with the expectation of rapid growth and quick returns on investment.

The Cost of Capital

The cost of capital isn’t just a financial term, as it shows the reality of giving up a piece of your business in exchange for the funds to grow.

Interest on loans, equity given to investors, and even the time spent courting investors represent costs that entrepreneurs must weigh against the potential benefits.

The Impact of Startup Capital

Securing the right amount and type of startup capital can accelerate a business’s growth, allowing for:

- Faster market entry

- Enhanced product development

- Expansion into new markets

- Hiring essential talent

- Implementing marketing strategies to reach a wider audience

However, it’s essential to balance these benefits with the potential drawbacks, such as the pressure to deliver rapid growth and the possibility of diluting ownership.

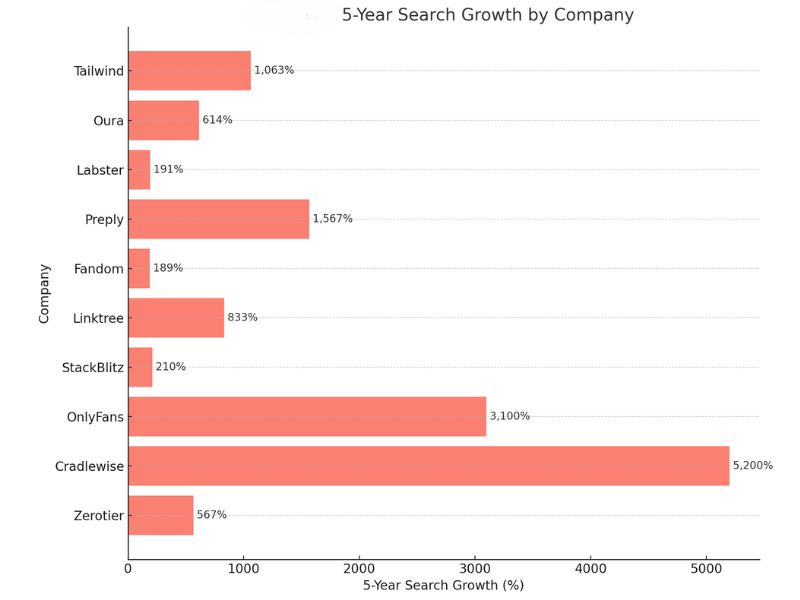

Top Startups In 2024

Here’s the list of the top startups that absolutely dominate in 2024. You can check them out and, perhaps, take a page from their book for your own project.

| Company | 5-Year Search Growth | Year Founded |

|---|---|---|

| Zerotier | 567% | 2015 |

| Cradlewise | 5,200% | 2019 |

| OnlyFans | 3,100% | 2016 |

| StackBlitz | 210% | 2018 |

| Linktree | 833% | 2016 |

| Fandom | 189% | 2004 |

| Preply | 1,567% | 2012 |

| Labster | 191% | 2011 |

| Oura | 614% | 2013 |

| Tailwind | 1,063% | 2012 |

Closing Thoughts

Startup capital is the lifeline for turning ideas into successful businesses.

From the initial pre-seed stage to potentially securing venture capital, each step involves strategic planning, clear communication, and a deep understanding of both your business and the needs of your potential investors.

With the right approach, securing startup capital can pave the way for innovation, growth, and long-term success.

Related Posts:

- Roblox Unblocked Review 2024 - Access, Features, and…

- What Is One Way to Begin Saving Startup Capital?…

- How To Grow Your Startup Without External Capital -…

- Startup's Guide to Venture Capital Funding - How To…

- Oda, SoftBank-Backed Grocery Startup, Cuts 150 Jobs…

- Top 17 Capital Goods Companies to Watch in 2024