If you want to start a business, you need money. (As simple as that)

That’s what startup capital is: the money you need to get your idea off the ground.

But where do you get it?

You have a few options: you can use your savings, borrow from a bank, or pitch to investors who believe in your vision.

How you raise and use your startup capital can make or break your business.

That’s why you need to understand what it is, why it matters, and how to get it.

In this article, I’ll share with you everything you need to know about startup capital and how to use it wisely.

Table of Contents

ToggleThe Most Efficient Solution

When it comes to saving startup capital, efficiency matters.

Entrepreneurs face the challenge of stretching every dollar to its utmost potential.

Prioritize Expenses

First, focus on what truly matters.

Every startup has core operations that need funding – these are non-negotiable.

However, many other expenses do not directly contribute to growth or operational success.

Identify these and cut them out.

This approach ensures that every dollar spent goes towards generating value for the business.

Experts from Chase also prioritize expenses as a first action:

“You’ll have costs like registering your company, getting licenses, buying equipment, and paying for things like insurance, office space, and marketing. Also, think about ongoing expenses like paying employees, buying supplies, and handling taxes and legal fees.”

Adopt New Technologies

Technology offers tools and services that can automate and streamline various business processes.

You can use accounting software that manages finances, or digital marketing tools that reach customers more effectively.

These solutions can reduce the need for a large workforce and cut down operational costs.

The data these tools generate can help make informed decisions, further saving costs and improving efficiency.

Here is an Example of How Technology Can Save Money in the Long Run

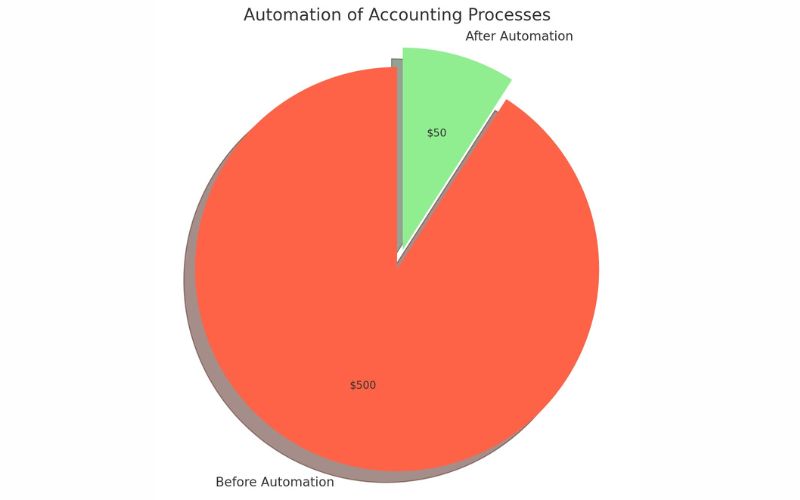

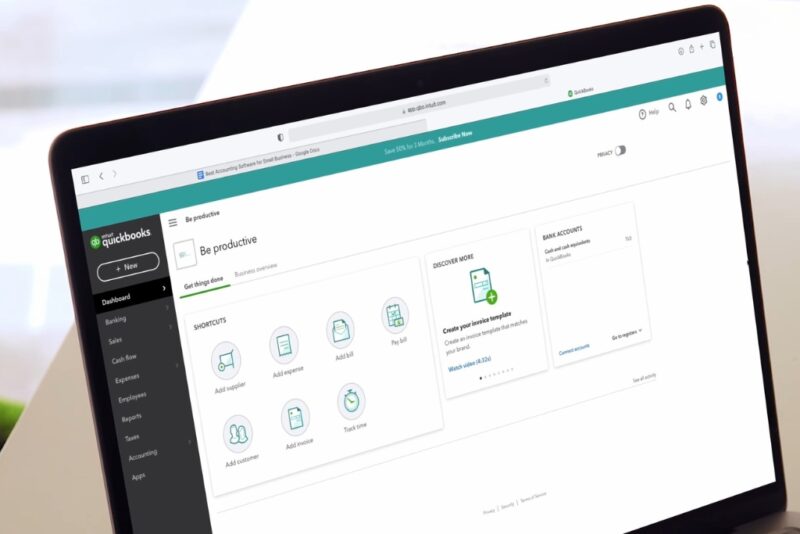

Example: Automation of Accounting Processes

Let’s take the case of a startup that currently manages its accounting and financial management either manually or by hiring an external accountant. Typically, small business accounting services can be quite expensive, averaging around $500 per month. However, by transitioning to accounting software, which may cost approximately $50 per month, the startup can substantially decrease its expenses.

- Before Automation: $500 per month for external accounting services.

- After Automation: $50 per month for accounting software subscription.

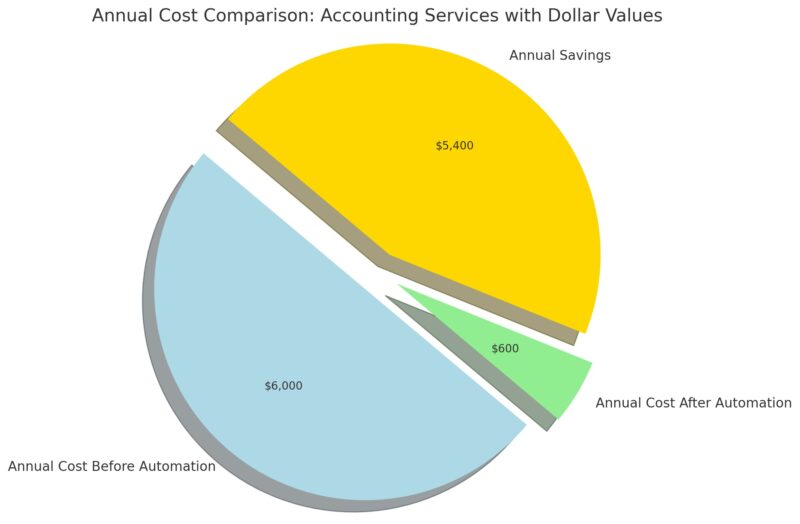

Annual Savings Calculation

- Annual cost before automation: $500 x 12 = $6,000.

- Annual cost after automation: $50 x 12 = $600.

- Annual Savings: $6,000 – $600 = $5,400.

This example shows that by adopting accounting software, a startup can save up to $5,400 annually. This significant saving demonstrates the power of leveraging technology for financial efficiency within a startup.

Go Lean

Consider adopting the lean model, prioritizing operational flexibility and a minimalist approach.

The main goal is to create more value for customers while utilizing fewer resources.

This strategy encourages startups to quickly test their product or service in the real market using a minimum viable product (MVP) before making significant investments.

Flexible Workforce

Consider a flexible approach to staffing.

Full-time employees represent a significant fixed cost.

Instead, look to freelancers, independent contractors, or part-time workers for roles that do not require full-time attention.

Funding Wisely

Loans and credit cards can provide quick access to funds, but they come with the added burden of interest.

On the other hand, venture capital and angel investors offer capital as well as valuable expertise and networks, albeit in exchange for a share of equity.

Another intriguing option is crowdfunding, which presents a unique opportunity to validate the product while also securing financing.

It allows for early engagement with potential customers and can serve as a means of gathering support and feedback during the process.

Aggressively Managing Day-to-Day Expenses

When you start a business, every dollar counts.

Tight control over daily expenses can significantly boost your startup’s financial health.

It’s about making smart choices that keep costs low while still maintaining the quality of your business operations.

Tips for Reducing Daily Expenses

- Downsize Living Accommodations: Consider your current living situation. Do you need all that space? Moving to a smaller place or a less expensive area can free up a lot of cash. For example, if you’re renting an office space, ask yourself if you can work from a home office or share office space with another business.

- Cut Unnecessary Utility Expenses: Take a close look at your monthly utility bills. Simple changes like switching to energy-efficient lighting or adjusting the thermostat can lower these costs. If you work from home, using natural light during the day instead of artificial lighting can make a noticeable difference in your electricity bill.

- Cancel Non-Essential Subscriptions and Services: Monthly subscriptions can slowly drain your bank account. Review every subscription you have, from software to magazines, and ask yourself if it’s essential for your business’s daily operations. Many times, there are free alternatives that can serve the same purpose.

Real-World Example: Reducing Subscription Costs

Original Subscriptions:

- Project Management: Trello Business Class – A popular tool for project management, Trello’s Business Class plan offers advanced features suitable for startups. The cost is approximately $10 per user per month. For a small team of 5, this equates to $50 per month.

- Accounting Software: QuickBooks Online – QuickBooks Online is widely used for accounting and financial management among small businesses. The Essentials plan costs around $50 per month, offering functionalities like bill management, time tracking, and up to three users.

Total Original Monthly Cost: $100 (Trello) + $50 (QuickBooks) = $150

Cost-Saving Alternatives:

- Project Management: Asana Ba sic Plan – Asana offers a Basic Plan that is free for teams of up to 15 members. While it may not have all the advanced features of Trello’s Business Class, it covers most needs for task and project management for startups.

- Accounting Software: Wave – Wave provides a free accounting software solution for small businesses, covering features such as invoicing, accounting, and receipt scanning without any monthly fee.

Total Cost with Alternatives: $0 (Asana) + $0 (Wave) = $0

Annual Savings: $150 per month x 12 months = $1,800

Analysis:

By switching from paid subscriptions to free alternatives like Asana for project management and Wave for accounting, a startup can save $1,800 annually.

It can be redirected toward other critical areas of the business, such as product development, marketing, or emergency funds.

Learn More About Government Grants and Incentives

Startups frequently underestimate the potential financial support available through government grants and incentives.

Unlike loans, these funds do not require repayment, making them an attractive option. To access this valuable resource, begin by researching grants specific to your industry or region.

Government websites and local business support organizations are excellent starting points to explore the available opportunities.

Key points to consider:

- Eligibility Criteria: Understand the requirements. Some grants target specific industries, stages of business, or types of innovation.

- Application Process: Prepare thoroughly. Applications often require detailed business plans, financial statements, and a clear explanation of how the grant will benefit your business.

- Compliance and Reporting: Be ready for oversight. Grants may come with conditions, such as regular progress reports or audits.

I’ve found a great example in Australia, the CSIRO Kick-Start Program. Maya Lash, a lawyer, provided more details in an article on Legal Vision:

The business is required to match the funding that CSIRO provides, which can be between $10,000 and $50,000. To be eligible for the CSIRO kick-start program, your startup must have:

-

-

-

an annual turnover and operating expenditure of less than $1.5 million; or

-

been registered for less than three years.

-

-

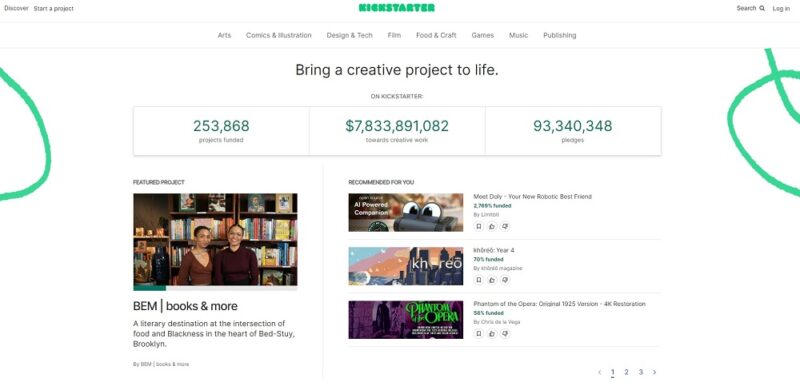

Explore Crowdfunding Options

Crowdfunding platforms like Kickstarter and Indiegogo offer a way to raise funds directly from customers, fans, or anyone interested in your project.

Steps to a successful campaign

- Choose the Right Platform: Select one that aligns with your project type and goals. Some platforms are better suited for creative projects, while others focus on technological innovations.

One of the most successful crowdfunding examples comes from the Pebble Time smartwatch campaign on Kickstarter. In 2015, Pebble Technology sought to fund the production of their new smartwatch, the Pebble Time. They set an initial funding goal of $500,000. The campaign struck a chord with consumers and technology enthusiasts around the world, quickly surpassing its goal. By the end of the campaign, Pebble Time had raised over $20 million from nearly 78,000 backers, making it one of the most funded projects in Kickstarter history at the time.

- Craft a Compelling Story: Your campaign should tell a compelling story about your product and why it matters. High-quality videos and images can help capture attention.

- Set Realistic Goals: Determine how much money you need and set a realistic funding goal. Remember, some platforms require you to meet your goal to receive any funds.

- Promote Your Campaign: Use social media, email newsletters, and personal networks to spread the word. Engagement and momentum are key to reaching your funding target.

Success tip: Offer attractive rewards or incentives to backers. Exclusive updates, early access to products, or unique experiences can encourage more people to support your campaign.

You should also check out other successful stories, like this one, where Read AI collected $21 million in funding from Goodwater Capital and Madrona Venture Group.

FAQs

Some of the most profitable businesses to start in 2024 are:

- Cleaning services

- Investment and asset management

- Renewable energy

- Gaming Software

- Business Consulting

Related Posts:

- Startup's Guide to Venture Capital Funding - How To…

- Indian Startup YogiFi Introduces Smart Yoga Mat with…

- Building a PR Team - A Startup's Guide to PR Management

- What Is Startup Capital - Types, Sources, and Tips

- How To Grow Your Startup Without External Capital -…

- From Idea to Prototype - A Step-by-Step Guide