Adam Neumann’s attempt to repurchase WeWork came to a halt this week. On Monday, a bankruptcy court approved a restructuring plan for WeWork, which includes $450 million in financing primarily from Yardi Systems, a creditor and tech provider in real estate.

This deal will help WeWork eliminate $4 billion in debt and is set to bring the company out of bankruptcy by the end of May, effectively ending Neumann’s chances of reclaiming the company he co-founded and was ousted from by investors, despite his offers exceeding $500 million and promising to top any competing bids by 10%.

Neumann, through a spokesperson, declined to comment on whether he will continue his attempts to acquire WeWork or what this development means for Flow, his new venture aimed at revolutionizing the residential rental market.

Susheel Kirpalani, a lawyer for Flow, expressed skepticism about the sale process, stating, “WeWork has misled the court for weeks and now plans to sell to a group led by Yardi for significantly less than our ongoing proposals. We expect strong opposition to this plan.”

Despite this, WeWork is ready to move forward. CEO David Tolley highlighted the company’s six-month effort to devise a reorganization plan that would leave WeWork better funded and more operationally efficient, poised for growth and continued investment in its services.

In 2022, Neumann launched Flow with $350 million from venture capital firm Andreessen Horowitz. Initially, the specifics of Flow were vague, but Neumann has since clarified that the company aims to enhance the residential renting experience.

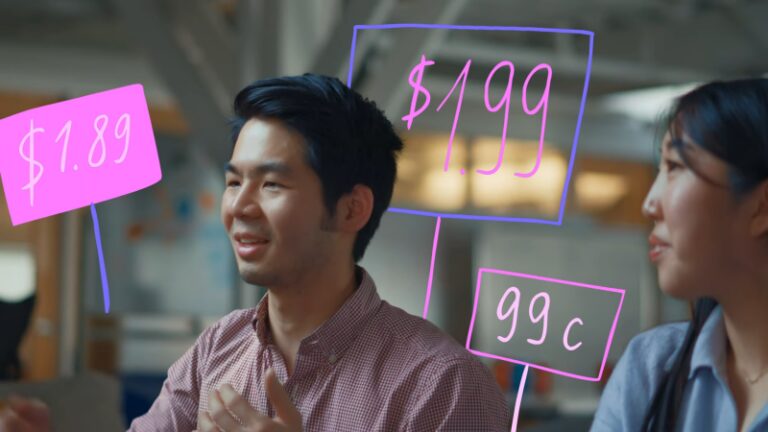

Flow has begun operations in Fort Lauderdale and Miami, rebranding properties under its name with improved amenities and new management technology. One-bedroom apartments start at approximately $2,500 in Fort Lauderdale and $2,900 in Miami.

Flow currently owns six buildings, including properties in Nashville and Atlanta, with plans for a $300 million mixed-use development in downtown Miami. Neumann’s previous venture into residential living with WeLive, a WeWork offshoot, did not succeed.

With the likelihood of partnering with WeWork diminishing, Neumann’s Flow seems set to compete as more individuals work remotely. According to Eric Koester, a Georgetown University professor, Neumann could become a “wartime CEO” by directly challenging WeWork, or he could focus on differentiating Flow from his former company.

Koester likened Neumann’s situation to Uber’s failed attempt to acquire Lyft years ago. “Rejection can be taken personally or brushed off,” he noted. Neumann could use this rejection as motivation to prove his detractors wrong or to pursue a different path with Flow.

Neumann describes Flow as a tech-driven, “experience-first” residential real estate company focused on community building among residents. This is exemplified by the recent expansion in South Florida, a hot spot for new, flexible living spaces that blend residential and rental opportunities.

Despite the growing interest in coworking and integrated living solutions, the economic viability of such models remains uncertain, especially in the wake of market shifts during the COVID-19 pandemic.

Some experts, like Bryant University’s Mike Roberto, question whether enhancing an apartment building with tech makes it fundamentally different from traditional real estate. Flow’s success, according to Roberto, will depend on aligning with what renters actually want in their living and working environments.